Table of Contents

- The VantageScore Credit Model: How Does It Operate?

- A Good VantageScore Is…

- 4.0 VantageScore

- The Variability of Your VantageScore

- To sum up

A number of scoring algorithms, including VantageScore, analyse the data in your credit reports and produce a score that expresses the chance that you will pay your debts on time. Your VantageScore may have appeared on your credit card bill or educational websites. Between July 2016 and July 2017, more than 1 billion VantageScore credit scores were directly given to consumers, claims VantageScore Solutions.

Consumer credit scoring business VantageScore Solutions LLC is situated in Stamford, Connecticut. The three main consumer credit reporting agencies, Equifax, Transunion, and Experian, the site’s publisher, jointly own the business, which was founded in 2006.

Your credit reports’ information, such as your payment history, credit utilisation, credit mix, and other factors, are used to determine your credit score. Credit scores are crucial because they can have an impact on everything from renting an apartment to obtaining a vehicle loan. They are used to determine your credit risk, or how likely you are to pay your obligations on time.

The VantageScore Credit Model: How Does It Operate?

Before credit scores were invented, a lender would have to look through a borrower’s credit history and assess each application’s chances of repaying a loan on their own. This required a great amount of training and talent in addition to a lot of time. Lenders are able to automate a component of the loan approval process by using credit scores, which simplify this process by condensing a person’s whole credit history to a single number. This ensures that an objective, consistent process is always being utilised to make these choices.

A Good VantageScore Is…

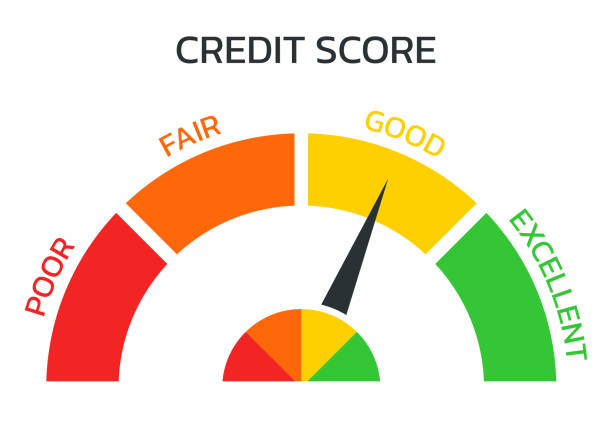

Scores between 700 and 749 are regarded as good, while those between 750 and 850 are deemed exceptional or super prime. Scores between 650 and 699 are considered fair, between 550 and 649 are considered bad, and between 300 and 549 are considered extremely poor.

Based on the information in your credit reports with each of the three credit agencies, your VantageScore is calculated. This data is put through an algorithm that determines your score based on the following criteria.

When determining the risk of lending to you, financial organisations frequently consult your VantageScore. A low score suggests a higher chance that you won’t be able to repay the money you borrow. Few lenders are going to be willing to take that chance. A high score suggests that the lender has a minimal chance of losing money, making them more willing to cooperate with you.

4.0 VantageScore

VantageScore has released four credit score models since it was founded. Versions 1.0 and 2.0 used a scale from 501 to 900, which was equivalent to the letter grades A through F. However, the 300 to 850 range was adopted by the VantageScore 3.0 model, which was unveiled in 2013. The range of 300 to 850 is also used in VantageScore 4.0, which was released in April 2017.

The VantageScore formulae have always used information from your credit history, such as payment history, average number of days an account has been open, credit kinds, credit utilisation, and most recent credit queries. However, trend data, which examines trends of behaviour rather than just a snapshot in time, is another notion used in VantageScore 4.0. On their credit score, for instance, individuals may benefit when they gradually pay off their debt.

When computing your VantageScore, the calculations do not take into account medical debt that is in collections, whether it has been paid in whole or not.

Note that none of the three credit reporting agencies—Experian, Equifax, and TransUnion—will record unpaid medical debt accounts that are less than $500 for a year. Medical collection accounts that have been paid won’t show up on your credit reports.

The Variability of Your VantageScore

Your VantageScore credit score is based on your credit records, just like any other credit score. Your creditors provide information to the three main consumer credit bureaus, such as whether you are paying your bills on schedule. But since not all financial institutions submit data to all three credit reporting agencies, the information at each one may change slightly. It’s also likely that certain providers of credit scores are utilising a different version of the VantageScore methodology since there are four of them.

Finally, the information in your credit report will have a significant impact on the score that is calculated. For instance, if you recently paid off a sizable obligation, it might not appear on your credit report until the following billing cycle. Only after that will your most recent account balance be used to create VantageScore or any other credit scoring model.

To sum up

An essential component of getting a loan is understanding credit ratings and the models used to calculate them. You’ll be more prepared to work to build the best possible credit score if you know what VantageScore is and how it operates.